Help

General FAQs

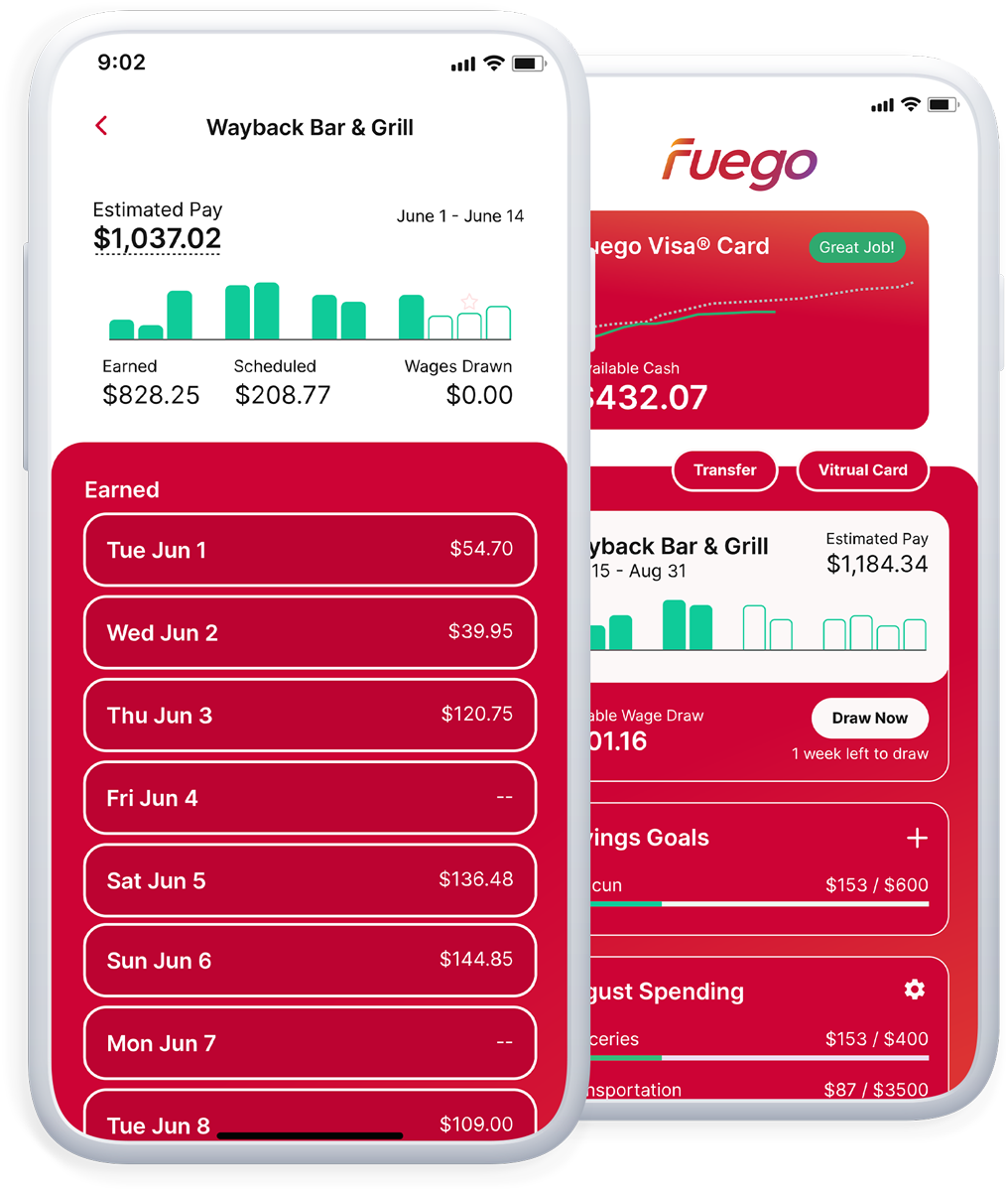

Can I use Fuego to access my earned wages early?

If your employer offers Fuego as a benefit, then you can use Fuego to access your hard-earned wages early. Just download the Fuego app*, we’ll connect you to your employer when you set up your Fuego account, and then all that is left is to choose how you want to receive your wages.

*Standard message and data rates from your wireless service provider may apply.

How do I access my earned wages?

Download the Fuego app* and let us connect you to your employer who provides the hours you worked plus your pay. Once your account is all set up, you can decide how much of your available earned wages (up to 50%) you would like to transfer to your own Fuego Visa® card, existing bank account or debit card.

*Standard message and data rates from your wireless service provider may apply.

If I use Fuego, am I borrowing money?

No, Fuego was built to provide access to wages you already earned, but that have not yet been paid to you. Using Fuego means that you are transferring your own earned wages into your Fuego Visa® Card, bank account or debit card. You can only transfer money that you have already earned and is due to be paid on your scheduled pay date. This removes your potential need to rely on loans or predatory lenders. Fees may apply for transferring your earned income based on the wage transfer option you choose; you will not be charged interest at any time.

Do I have to sign a (long-term) contract?

No, Fuego is a service that provides you access to your earned but not yet paid wages on an at will basis, so you can access and draw your wages when you need it. You can choose to use Fuego as frequently as you like.

If I draw wages, when will it be deducted from my paycheck?

The next time you receive your paycheck using Fuego, your wage draws will show as a deduction.

In other words, the earned wages that you don’t transfer before payday will simply be paid to you as a remainder payment on your scheduled payday.

How much does Fuego cost?

Fuego does not have any wage draw transaction fees when you set up direct deposit to the Fuego Visa® Card. In short, you pay $0 to draw your wages in minutes.

When depositing wages into an existing bank account or debit card, the wage draw fee is $1 for the first draw of the day. Subsequent draws come at no cost just in case you underestimated or if you also want to draw from another employer. Fuego also caps draw fees at $3 per weekly pay period or $5 per biweekly pay period.

Additional fees may apply for expedited transfers, $1 for same day ACH, or $2 to an external card.

How safe is it to use Fuego?

The Fuego Visa® card is issued by the Central Bank of Kansas City, Member FDIC, pursuant to a license from Visa® U.S.A. Fuego transactions to external banks and cards are processed by the Central Bank of Kansas City, Member FDIC.

So that means that the money you deposit in Central Bank of Kansas City, Member FDIC is covered by the federal government, up to $250,000 per depositor, per account ownership category.

How much money can I get from Fuego?

Every pay period, you can access up to 50% of what you’ve already earned, and transfer wages to your Fuego card, a bank account or debit card you already have.

How quickly can I request a draw after I worked?

As soon as the hours you have worked have been approved by your employer, up to 50% of your earned wages will be available.

How long does it take to get the money I requested?

Transfers to the Fuego Visa® Card are completed in minutes, 24/7/365. Transfers to bank accounts and other debit cards are completed within 48hrs.

Transfers to bank accounts or debit cards can be made for $2 p/transaction.

Transfers to bank accounts or debit cards made before 12:50 PM EST M-F can be expedited for same day ACH for $1 p/transaction.

Transfers to bank accounts or debit cards can be made after 12:50 PM EST M-F are processed the next business day.

If I take a wage draw when will it be deducted from my paycheck?

Wage draws accessed using Fuego will show as deduction on your next paycheck.

What if I change jobs?

If you leave your current employer, and move to another employer elsewhere, you can keep your Fuego account, set up direct deposit with your next employer using your Fuego account, and use your Fuego Visa® Card for all your purchases. Your employer would need to offer Fuego On-Demand Pay for you to be able to access your wages early using Fuego.

How can I recommend Fuego to my employer?

1) telling your employer about Fuego, how helpful it can be, and to have your employer complete the “Fuego Get Demo” form that appears on the bottom of each getfuego.com webpage. Our team will be in touch with your employer after submitting a request for demo for more details. Or 2) you can also call 1-855-715-8518 to let us know directly that you would like to use Fuego, and then we will make sure to contact your employer and see if they can partner with Fuego.

Our team will be in touch with your employer after submitting an inquiry for more details, and we will reach out to your employer after you have submitted a personal request for your employer to integrate Fuego.

Business FAQs

How do businesses offer Fuego to their employees?

As a HotSchedules customer, Fuego utilizes the Schedule and POS data connections that already exist. The time and attendance data is used to provide earned wage access to employees, there’s no cost to the business in offering Fuego as a employee benefit.

Who is responsible for providing the money accessed by Workers?

Fuego funds the draws requested by the employee and the employer settles with Fuego as a part of payroll processing. The employer does not have to provide a float.

How are the draws repaid?

The draw is against earnings for time already worked which are deducted from the payroll and repaid to Fuego by the employer.

What is required to offer Fuego Earned Wage Access?

Basic employee registration details, shift data, and tip data, which can be shared from HotSchedules. The employee must also provide account details direct to Fuego for receiving the funds. The employer will need to process a deductions file for reimbursements via payroll.

How much does it cost to offer Fuego?

For Businesses, Fuego is a $0 cost benefit that can be offered to your workers to facilitate both access to a card program, financial well-being tools and availability for access to earned, but not yet paid, wages. While there is zero cost to the employer, there will be minor time investments to educate and promote the program to your employees. Fuego will empower you with marketing materials to reach your employee base in a low touch manner. Reach out to us for more information on Fuego.

How does Fuego receive time and attendance data?

Via integration with HotSchedules or POS/Timeclock.

How long does it take to start offering Fuego to employees?

We can set Fuego services up for you in 48 hours however our team will work with you to agree on a roll-out plan suited to your organization.

I have a more specific question, how can I get help?

If you have a specific question about Fuego that is not answered here, there is a help section within the Fuego app where you may be able to find the answer to your question. If you still need help, you can contact our customer support team. They are available Monday through Sunday via the live chat in the Fuego app, or via phone at 1-855-715-8515 from 8:00 a.m. ET to 10:00 p.m. ET Monday – Friday, and 9:00 a.m. ET to 5:00 p.m. ET Saturday and Sunday.

Employees FAQs

How does Fuego help your financial health?

Fuego wants to help you get ahead in life. It’s not just about early access to wages, it’s also about your financial health in the long run.

That’s why Fuego gives you access to financial health and wellness articles, and helps you budget, develop savings goals or set goals to pay off potential debt. You can also access your spending history so that you can manage where you spend your money and where you could potentially save.

How long does it take to receive my card?

After you are approved for the Fuego Visa® Card, your virtual card details are available immediately and can manually be added to your digital wallet (Apple©, Google© and Samsung Pay©). Your physical card will arrive by mail in 7 to 10 business days.

How are the draws repaid?

The draw is against earnings for time already worked which are deducted from the payroll and repaid to Fuego by the employer.

How can I check my balance on the card?

You can check your balance 24/7 by checking your Fuego mobile app on your dashboard, or you can reach our customer service team at 1-855-715-8518. You can also check your balance at any MoneyPass® ATM surcharge-free, or any other ATM (fees may apply).

How do I receive my wage draws?

Wage draws to your Fuego Visa® Card are completed in minutes, and are surcharge free. For all other wage draws to your external accounts, Fuego works with payments networks (Visa®, Mastercard) for instant transfers to your external cards, and the ACH network for same day or traditional ACH transfers to your external bank accounts.

Will Fuego work with my existing debit card?

Yes, with the Fuego app you can transfer funds to your existing debit card from almost any financial institution.

Need Fuego Support?

An Earned Wage Access App That Keeps Up With the Hustle

Request a demo to learn more about Fuego On-Demand Pay.